Having spent time abroad creates new avenues for returning to India but is to be done with proper financial planning about foreign investments. It might be stocks, real estate, mutual funds, or even cryptocurrency. The bottom line for a smooth transition is in the management of assets. In this regard, an article is composed based on a guide on how to handle foreign investments while relocating to India; information gathered from Prime Wealth financial advisory firm is included.

Knowledge about Foreign Investments

You would have invested in any of the following types while staying abroad as an NRI:

- Real Estate: Overseas bought properties.

- Stocks and Bonds: Shares of overseas companies or governments.

- Mutual Funds and ETFs: International funds.

- Pension and Retirement Accounts: In foreign retirement accounts, saving

- Cryptocurrencies: International currencies online.

Many NRIs have huge investments in foreign real estate, particularly when they are already staying in such countries, like the US, UK, or UAE. According to the latest Global Wealth Migration Review 2023, Indian investors have more than $5 billion in overseas properties. The question of what to do with these assets is a hard decision in terms of your personal financial planning on returning to India.

5 steps toward managing foreign investments

- Sizing up Liquidity This starts with the analysis of foreign investment in terms of liquidity. The liquid assets included are stocks and mutual funds because they can quickly be sold and transferred. Otherwise, illiquidity assets for example real estate will take some time before they are released. One would seek financial advisors like Prime Wealth to establish the possibility of the sale or not to hold offshore assets.

- Repatriate Funds into India The funds will be repatriated to India if liquidation of the foreign investments is desired. FEMA does allow remittance into India by opening an NRO account or an NRE account for NRIs. From an NRO account, an NRI may repatriate up to $1 million in a particular financial year. Therefore, strict compliance with FEMA regulations would be crucial to effective remittance.

- Tax Consequences in India Tax implications are a very critical concern while dealing in foreign investments. The sale proceeds of foreign real estate could also be taxable in both countries as per DTAA. Companies like Prime Wealth have experience and expertise in counseling NRIs in minimizing tax liability by exploiting DTAA benefits in keeping you in the Indian tax compliance framework.

https://nrireturntoindia.com/double-taxation-avoidance-agreement-dtaa-for-nris/ - To Invest or Liquidate Foreign Real Estate If one has property abroad, the decision to hold or selling is very critical. Selling could provide liquidity that can be invested in India. Holding real estate could provide rental income or long-term gains. The RBI allows NRIs to remit the sale proceeds of foreign properties. However, considering market conditions, tax implications, and long-term goals would be advisable. Depending on the financial objectives of an individual, Prime Wealth, for instance, could be consulted in order to know which will suit the case.

- Pension or Retirement Accounts It is quite a complex task to deal with foreign pension or retirement accounts. Pension funds transfer or liquidation rules vary from country to country. For example, transferring US 401(k) plans or UK pensions to India normally has tax implications. Getting the rules directly from financial planners such as Prime Wealth would be helpful in knowing whether one should let the accounts continue in an overseas country or repatriate them to India.

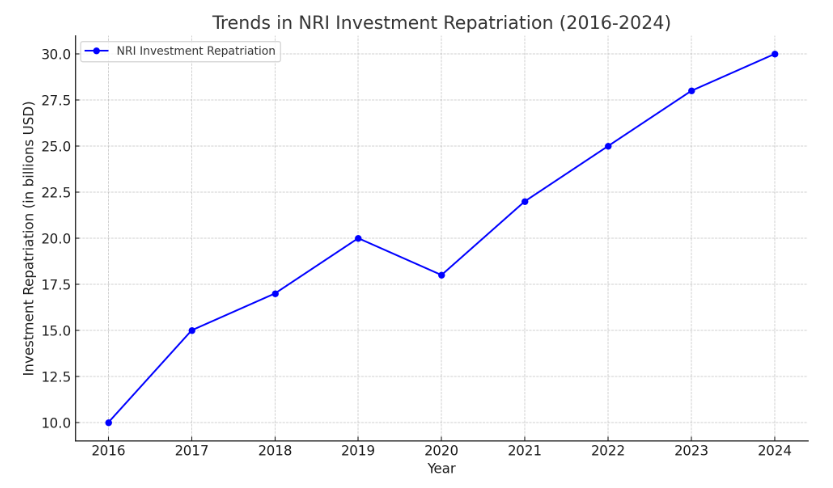

Trends in NRI Investment Repatriation

Of late, an increasing number of NRIs have been bringing foreign investments into India. The liquidation of foreign assets by NRIs has risen by 30% in the current year 2024, and this happens largely because of decent currency exchange rates and rising investment opportunities in the Indian markets. Prime Wealth indicates in its 2024 NRI Investment Outlook that most NRIs are coming back to repatriate those funds to be invested back in Indian real estate, mutual funds, and government bonds as market conditions turn favorable.

Conclusion: Streamlining the Reverse Migration

Investments could seem a complete task while planning to move to India, but it opens very new monetary chances if planned and managed well. It would not prove to be any problem in selling or even retaining or repatriating assets if one could go ahead consulting the experts from Prime Wealth so that the movement remains smooth. Risk is reduced through maximizing returns by knowing the liquidity, tax implications, and rules on repatriation.

FAQs

1. What are my options for foreign investments when moving back to India?

Ans- You can choose to sell, hold, or repatriate your foreign investments, depending on their type and liquidity.

2. How can I repatriate funds from foreign investments to India?

Ans- You can use an NRO or NRE account to repatriate proceeds from foreign assets under FEMA guidelines, with a limit of $1 million per financial year.

3. Are my foreign investments taxable in India?

Ans- Yes, the income from foreign investments may be taxable in India, but you can use Double Taxation Avoidance Agreements (DTAA) to reduce your tax liability.

4. Should I sell my foreign real estate before moving back to India?

Ans- It depends on your financial goals. Selling provides liquidity, but you may want to hold onto the property for future gains or rental income.

5. What are the tax implications of repatriating foreign investments?

Ans- The tax implications vary based on the country and type of investment. Consult experts like Prime Wealth to understand the tax regulations in both countries.

6. Can I transfer my foreign pension funds to India?

Ans- Transferring foreign pension funds may have tax consequences, depending on the country’s rules. It’s advisable to seek professional advice.

7. What happens to my mutual fund investments abroad?

Ans- You can choose to redeem or hold your mutual fund investments abroad. Selling may incur taxes, so it’s important to review the implications before taking action.

8. Can I reinvest repatriated funds in India?

Ans- Yes, you can reinvest repatriated funds in Indian stocks, real estate, or mutual funds through an NRE or NRO account.

9. How do I avoid double taxation on my foreign income?

Ans- Leverage DTAA agreements to avoid paying taxes on the same income in both countries. Financial planners can help you navigate these agreements.

10. Can I hold on to my foreign cryptocurrency investments?

Ans- Yes, you can hold or liquidate your cryptocurrency investments, but be mindful of both local and Indian regulations concerning crypto assets.

Disclaimer: The information provided here is for educational and informational purposes only and should not be construed as financial, legal, or tax advice. Consult with a qualified professional before making any investment decisions. We do not accept any liability for errors or omissions in this information nor any direct, indirect, or consequential losses arising from its use.